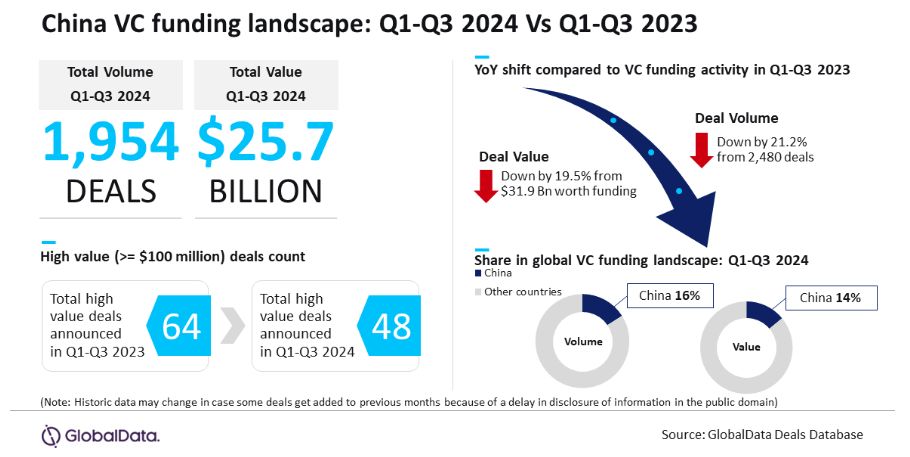

Venture capital ( VC ) funding in China continues to decline, with 1,954 deals worth US$25.7 billion announced during the first three quarters of 2024, down 21.2% in volume and 19.5% in value from a year earlier, according to data and analytics provider GlobalData.

In Q1-Q3 2023, a total of 2,480 VC deals worth US$31.9 billion were announced in the country, according to the firm’s deals database.

“China has been experiencing a downturn in VC funding activity for quite some time now. Several factors, including the crackdown on companies, economic challenges, and geopolitical tensions, seem to be at play in making a dent in investor sentiments,” says GlobalData lead analyst Aurojyoti Bose.

China also witnessed a fall in the number of big-ticket deals. The number of VC transactions valued at US$100 or more fell to 48 in the first nine months of the year, from 63 a year ago.

Nonetheless, despite the subdued activity, China continues to top the Asia-Pacific market and is also a key global VC funding market standing just next to the United States in terms of both deal volume and value.

China accounted for 16% share of the total number of VC deals announced globally during Q1-Q3 2024 while its share of corresponding funding value stood at 14%.